The tax hikes endorsed by many Democratic presidential candidates will eliminate up to 413,000 jobs, according to a new analysis.

Former vice president Joe Biden, Sen. Elizabeth Warren (D., Mass.), and other 2020 Democratic hopefuls have pledged to reverse President Donald Trump's 2017 tax cuts and hike corporate tax rates to as high as 35 percent to fund expensive government programs. Such policies will discourage corporate investment, thereby limiting growth in wages, employment, and productivity, according to an analysis from the Tax Foundation.

"The corporate income tax is the most harmful tax to economic growth, so it shouldn't be seen as a good option for funding various policy proposals," Erica York, the economist who compiled the study, told the Washington Free Beacon.

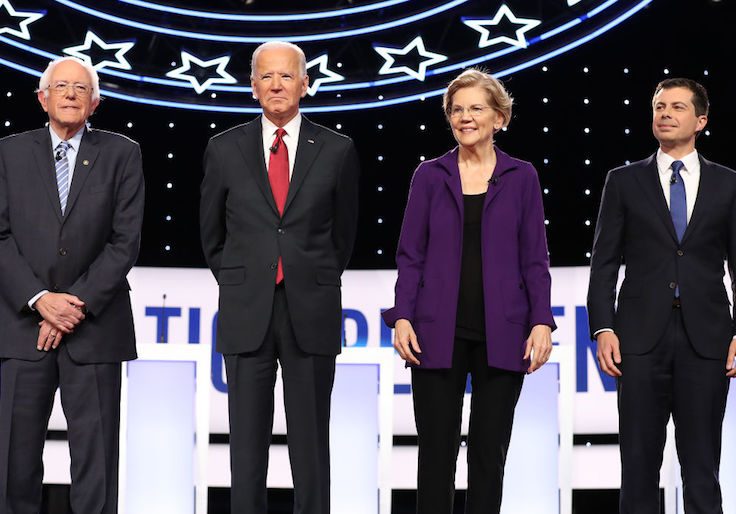

The 2017 tax cuts reduced corporate tax rates from 35 to 21 percent, helping spur a modest economic uptick. That policy has been a top target for Democrats seeking to run against Trump in 2020. Biden has suggested raising corporate tax rates to 28 percent, while Warren, Sen. Bernie Sanders (I., Vt.), and South Bend mayor Pete Buttigieg have advocated for returning the tax rate to 35 percent.

All of those proposals would eliminate jobs and hurt the broader economy, according to the study.

Biden's corporate tax plan will cut the GDP by 1 percent and shave off 187,000 jobs from the U.S. economy. Meanwhile, the tax plan backed by Warren, Sanders, and Buttigieg would leave 413,000 people without work.

The Tax Foundation analysis studies the negative economic effect of corporate tax hikes in isolation from how the additional government spending fueled by the higher tax revenue may affect the economy. York said that returning to pre-2017 tax levels will restore corporate tax burdens to exceptionally high levels compared with other advanced industrial countries.

"When we had a 35 percent rate, we were an outlier amongst most of our competitors," she said. "We had one of the highest corporate tax rates in the industrialized world. Lowering it made us more competitive, raising it back up would be a step in the wrong direction."

Democratic hopefuls have characterized the 2017 tax reform as a handout to the rich, despite the fact that four in five American taxpayers have received smaller tax bills since it passed. Warren has gone even further and called for an additional 7 percent tax on every dollar of profit above $100 million.

York said such hikes would reverberate through the wider economy, because increasing corporate taxes would leave corporations less inclined to invest in the workforce or in future development.

"Higher corporate income tax rates will mean some investments that would have been worthwhile under the old tax codes will no longer be worthwhile under the higher tax rate," York said.