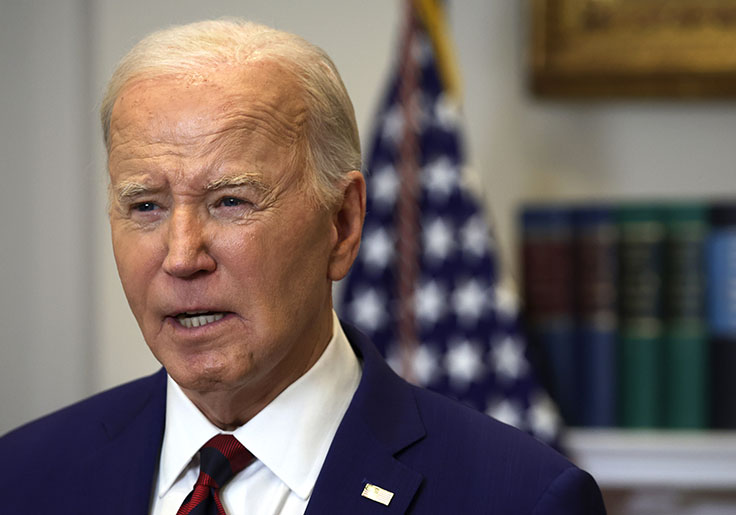

The latest Bureau of Labor Statistics report shows consumer prices again rose faster than expected, spelling trouble for President Joe Biden as he makes his case for reelection in his race against Republican nominee Donald Trump.

The Consumer Price Index in March rose 0.4 percent over the previous month and 3.5 percent over the prior year, according to a BLS report published Wednesday morning. Economists had forecasted a monthly increase of 0.3 percent and an annual increase of 3.4 percent, Bloomberg reported.

The "core" CPI, which excludes food and gas costs, increased by 0.4 percent month-over-month and 3.8 percent year-over-year, also surpassing economists’ projections of a 0.3 percent monthly and a 3.7 percent yearly rise.

"Today’s crucial CPI print has likely sealed the fate for the June [Federal Open Market Committee] meeting with a cut [in interest rates] now very unlikely," Seema Shah, chief global strategist at Principal Asset Management, told Bloomberg.

"This marks the third consecutive strong reading and means that the stalled disinflationary narrative can no longer be called a blip," Shah added. "In fact, even if inflation were to cool next month to a more comfortable reading, there is likely sufficient caution within the Fed now to mean that a July cut may also be a stretch, by which point the US election will begin to intrude with Fed decision making,"

The Wednesday report adds to a string of unfavorable economic reports for Biden in recent months, further jeopardizing his reelection campaign against Trump as economic issues have been at the top of voters' concerns in polls.

The BLS had reported higher-than-expected CPI for three consecutive months—in February, January, and December. Another BLS report showed the Producer Price Index, which tracks the cost of materials that producers and manufacturers purchase from suppliers, rose by 0.6 percent in February, double the expected 0.3 percent that Dow Jones had forecasted.