At the Senate Committee on Health, Education, Labor, and Pensions hearing on Tuesday, representatives from insurance companies and state-based exchanges said that giving states more flexibility will help prevent more volatility.

Allison O'Toole, the CEO of Minnesota's state-based exchange MNsure, said there has been volatility in the individual market as a major insurer pulled out of the market, which drove premiums up more than 50 percent.

Despite the hardship, O'Toole says a record number of people signed up last enrollment season, and now 96 percent in the state are covered.

"I have seen first-hand the value of state flexibility in responding to turbulent market conditions and the effectiveness of state-level policy initiatives that have improved conditions over the last year," O'Toole said. "MNsure has full control over our outreach programs, which means we are able to tailor activities to meet the needs of Minnesotans."

O'Toole says her top four priorities for stabilizing the market are continued flexibility for ACA section 1332 waivers, flexibility for state-based exchanges, funding cost-sharing reduction payments, a long-term federal reinsurance program, and enrollment outreach.

"Bipartisan action by the state on premium relief and a reinsurance program has mitigated some of the premium increases for Minnesotans, but premiums and out-of-pocket costs remain too high and provider networks too narrow for many Minnesota families," O'Toole said. "These state actions are short-term fixes, and we share the widespread recognition that action at the federal level is needed to add certainty, stability, and strength to individual markets across the country."

Bernard Tyson, CEO of Kaiser Foundation Health Plan, Inc. and Hospitals, said that giving states more flexibility and repealing the health insurer tax will help reduce costs.

"It is important to provide states with flexibility to respond to market conditions and come up with innovative solutions that can ultimately improve coverage nationwide," Tyson said. "It makes sense to expedite the consideration of [1332] waivers by the administration; it can be done faster than 180 days, especially for waivers substantially similar to those already approved."

In addition, Tyson says that the health insurer tax increases the cost of health insurance, which in turn increases costs for consumers.

Michael Leavitt, the former governor of Utah and former secretary of health and human services, agreed that states need more flexibility because they are more capable than the federal government to operate the exchanges.

"I recommend that CMS work with states to create a series of model 1332 waivers that states can choose from to accelerate solutions," Leavitt said. "By doing so, the federal government creates national standards, but allows states to develop state solutions."

"There could be a set of standard waivers related to risk stabilization programs, redefining marketplace products or benefits, or alternative private exchange portals," he explained. "This fosters collaboration and investment in the waiver process—as well as to expedite the application process."

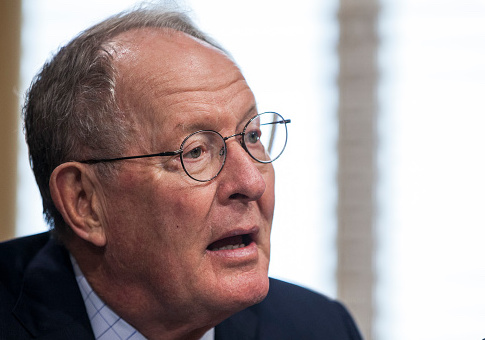

Committee chairman Sen. Lamar Alexander (R., Tenn.), who has hosted a series of hearings on stabilizing the marketplace, says that after this third hearing there are three common themes: "First, Congress should approve continuing funding of the cost-sharing payments that reduce co-pays and deductibles for many low-income Americans who buy insurance on the exchanges. Second, the option of low-cost 'copper' plans for everyone. And third, advocated by state insurance commissioners, governors, and senators from both sides of the aisle, was to give states more flexibility in the approval of coverage, choices, and prices for health insurance."