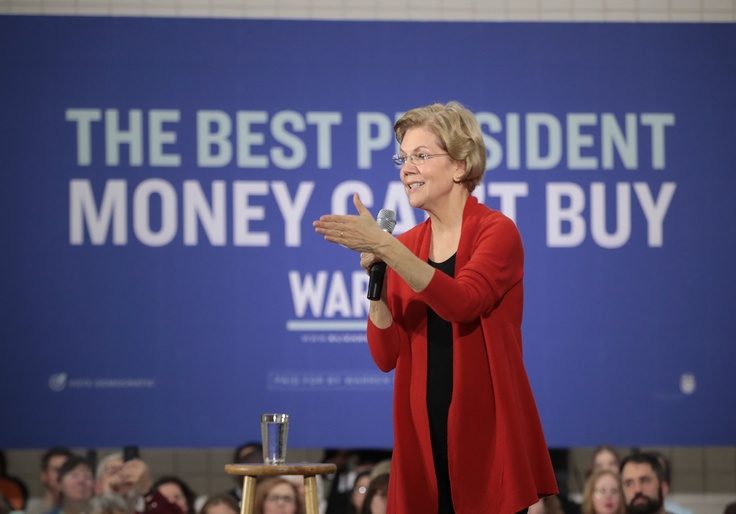

Presidential hopeful Sen. Elizabeth Warren (D., Mass.) has staked her campaign on doing away with the financial relationships she says have corroded government and made it a playground for the wealthy and connected. She has pledged not to "take a dime of PAC money" or "a single check from a federal lobbyist."

"If you don't have money and you don't have connections," Warren said in a speech announcing her presidential campaign, "Washington doesn't want to hear from you."

But the purity test Warren has established for herself and her rivals on the campaign trail—where she routinely criticizes opponents for hobnobbing with wealthy donors—stands in stark contrast to the actions she took as she ascended the political ladder when she maintained a close relationship with a dark money group led by some of America's most powerful labor unions and interest groups. The group championed her rise from Harvard Law to the Obama administration and Senate.

As the head of the Consumer Financial Protection Bureau (CFPB), the Obama administration's consumer watchdog, Warren rewarded Americans for Financial Reform (AFR), which pressured the Obama administration to appoint her to the post in the first place. She gave the group unparalleled access to the CFPB while she led the agency, meeting with AFR associates on twice as many occasions as she did with any other Washington, D.C., interest group. As a member of the Senate, she has supported bills backed by the group. On the campaign trail, she has issued proposals that would benefit leaders of the group.

AFR, which represents more than 200 deep-pocketed liberal organizations including the AFL-CIO and the NAACP, is not required to disclose its donors. In 2010, it drummed up both grassroots and institutional support for Warren's appointment to the CFPB. AFR representatives went on a media blitz to support Warren and directed rank-and-file members to sign pro-Warren petitions that were submitted to the Obama administration. One letter to the White House sent by AFR's sister organization was signed by nearly two dozen of D.C.'s most powerful liberal interest groups.

"Elizabeth Warren is one of the great experts in the country on the economics of middle-class families and supporting them and protecting them," Heather Booth, the former executive director of Americans for Financial Reform, told NPR in 2010. "There's no one who has a background with the depth on the issues and the willingness to stand up to those biggest banks."

AFR's support for Warren continued after she left the agency. Her campaigns have received more than $37,000 from the 18 organizations that form the dark money group's steering committee. Campaign finance records show that representatives from those 18 groups have contributed roughly $10,000 to her 2020 presidential bid.

The Warren campaign did not respond to a request for comment.

Warren's dealings with AFR are at odds with the ethics proposals that she has championed on the campaign trail. She has pledged to "tackle the flow of dark money" in politics, but her anti-corruption proposals feature loopholes for special interest groups that donate heavily to Democrats. Her proposal to tax "excessive lobbying," for example, exempts labor unions—a leading voice in AFR leadership. Unions spent $1.7 billion on political activities during the 2016 cycle.

While there are few publicly available details about the group's finances, former executive director Heather Booth confirmed that every group on the 18-member steering committee pays money to the organization. Neither AFR nor most members of its steering committee responded to requests for comment. A spokesman for the AARP said the group supported financial reforms but has never endorsed a specific candidate for a political appointment.

AFR played a major role in the passage of the 2010 Dodd-Frank Act, which created the CFPB, and remains a major anti-Wall Street advocacy group in Washington, D.C. Warren participated in an AFR webinar on consumer finances in April 2010 in the months leading up to the bill's passage. The group came to Warren's aid when the Obama administration balked at the idea of appointing Warren to lead the agency after she reportedly clashed with the Democratic leaders. The White House dropped its resistance following a public pressure campaign from AFR and its members.

"Warren has shown a steadfast and tireless commitment to protecting consumers throughout her distinguished career and is without question the best candidate to run the new CFPB," then-AFR executive director Heather Booth said in a 2010 press release.

AFR derives its influence from institutional ties to some of the most powerful liberal advocacy groups in D.C. AFR’s umbrella organization, the Leadership Conference on Civil and Human Rights (LCCHR), submitted a letter to President Obama in August 2010 urging him to appoint Warren. The letter was co-signed by 21 top Democratic interest groups, including the AFL-CIO, International Brotherhood of Teamsters, SEIU, and NAACP, among others. Many of these groups sit on AFR's steering committee.

The Obama administration stopped short of officially nominating Warren but appointed her as a "special adviser" and de facto head of the new agency. No group met with Warren as often as AFR, according to monthly schedules released by the CFPB. Warren met or called with AFR or its umbrella organization on 10 separate occasions during her 11-month tenure. She acknowledged her special relationship with AFR at a 2011 congressional hearing, singling it out as her go-to group in D.C. Warren contacted AFR representatives like Executive Director Lisa Donner on seven separate occasions, hosting the group for a closed-door discussion at the CFPB headquarters and other locations. She also had phone calls with the leadership of AFR’s umbrella organization, chatting with LCCHR president Wade Henderson and Executive Vice President Nancy Zirkin on three separate occasions. Her last public appearance as the agency head came at a reception hosted by AFR on July 28, 2011.

AFR continues to advocate for anti-Wall Street legislation even after splitting into two separate wings—a non-lobbying and lobbying arm—in 2018. The two entities together raised nearly $11 million, according to 2018 tax forms obtained by the Washington Free Beacon. It is now aligned with the Democracy Alliance, another liberal dark money group that counts George Soros and presidential candidate Tom Steyer as major donors.

The reorganization has not diminished the coalition's influence on Warren.

In February 2019, AFR co-published a report accusing private equity companies of "manufacturing homelessness." The report said that the government should act to remedy the situation by, among other actions, "stemming predatory investments."

Three months after the report, Warren sent a letter demanding information from several financial institutions, many of which were singled out by AFR. Warren's correspondence cited AFR's research five times. In July, she unveiled the "Stop Wall Street Looting Act," which would heavily regulate private equity. AFR was one of the first groups to endorse the bill, saying the legislation is necessary to protect the public from interest groups that "wield enormous influence."