Late Friday night, the Senate joined the House in passing its tax reform framework, the Tax Cuts and Jobs Act, in a 51-49 vote.

The Senate Finance Committee said the measure would give a typical American family a tax cut of about $2,200 and would help drive more jobs to the United States by reducing the tax burden on businesses and families.

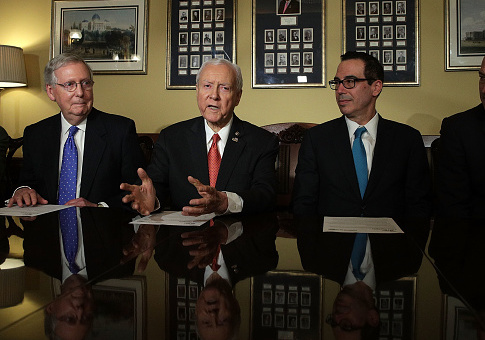

"Our tax reform bill was crafted with the primary purposes of providing tax relief to the middle class and growth to our economy," said Chairman of the Senate Finance Committee Orrin Hatch (R., Utah).

On the individual side, the bill doubles the standard deduction and expands the zero tax bracket while doubling the child tax credit, which will help reduce taxes for many middle-class American families.

"Under our bill, a family of four making the U.S median family income of around $73,000 a year will see their taxes go down by more than $2,000 a year," Hatch said. "Overall, this represents a nearly 60 percent reduction in that family's tax liability."

Hatch says that a single parent who earns $41,000 with one child can save about $1,400 on their tax liability.

The bill also attempts to improve simplification and repeals taxes such as the Obamacare individual mandate, which burdens middle- and low-income families.

On the business side, the bill reduces the corporate rate to 20 percent, lowers taxes for pass-through businesses, and allows for immediate expensing.

"All told, this means more expansion, more investment, and more jobs for U.S. workers employed by small businesses," Hatch said. "Make no mistake, this bill is pro-small business, which is why the National Federation of Independent Businesses, the largest small business association in the country, has enthusiastically expressed its support for our legislation."

The Tax Foundation scored the bill and found it would reduce taxes for most households in the United States.

"To help provide a sense of how the Senate's amended version of the Tax Cuts and Jobs Act would impact real taxpayers, we've run the taxes of nine example households," the foundation states. "Our results indicate a reduction in tax liability for every scenario we modeled, with some of the largest cuts accruing to moderate-income families with children."

For example, the foundation first scored a single individual with no dependents who earns a salary of $30,000. If this filer takes the standard deduction under current law, this person would likely owe $4,331 in taxes. Under the Tax Cuts and Jobs Act, this filer would instead pay $3,953—a 9 percent cut—and his after-tax income would increase by 1.3 percent.

The bill will go to conference where a resolution can be negotiated between the House and Senate versions.