A bipartisan group of lawmakers is hoping to head off a looming union pension crisis by expanding options for retirement benefits.

On Tuesday evening, Reps. Phil Roe (R., Tenn.) and Donald Norcross (D., N.J.) introduced the Give Retirement Options to Workers (GROW) Act, which would allow multiemployer pensions to transition from traditional defined benefit plans—in which fixed payments are delivered to retirees—to a hybrid that combines existing plans with 401(k)-style defined contribution plans, in which workers and employers contribute money to investment accounts. Roe said the reform is needed to preserve pension systems for future generations of workers.

"In a time of financial uncertainty, it is crucial that we give workers more flexible and sustainable options for creating stable retirement security," he said in a statement. "The GROW Act offers a fiscally responsible way forward, and this structure will enable pensions to maintain fiscal solvency in the future."

Multiemployer pension plans differ from those offered in other traditional blue-collar industries. While Ford is solely responsible for the retirement benefits of its employees, workers in the construction, truck driving, or shipping industries, for example, may handle contracts for numerous employers over the course of their careers. Employers in those industries pool their resources together to finance the benefits of those workers. Those plans face massive uncertainty today, as the number of companies contributing to those plans have dwindled. When a rival company closes, it is up to the remaining employers to cover the difference, saddling smaller pools of businesses with larger burdens to keep retirement plans above water.

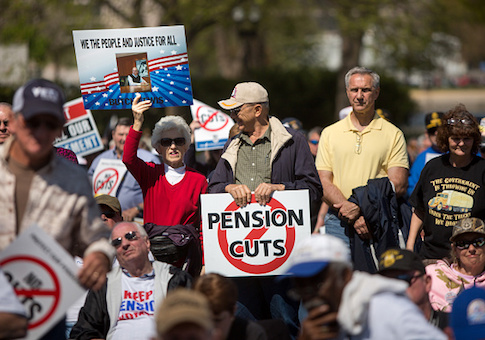

The future of multiemployer pension plans has already shown signs of turning into a crisis as the Baby Boomer generation moves closer to retirement. In 2014, the Obama administration signed a measure allowing pension plans to cut benefits with approval from federal regulators. In 2016 and 2017, members of Teamsters Local 707 in New York and Ironworkers Local 17 in Ohio had their benefits slashed after their pension funds ran out of money. The Pension Benefit Guarantee Corporation, a federal agency funded by user fees rather than taxpayers, had to step in to provide relief. The PBGC, however, is on the path to bankruptcy within the next decade if not sooner. The Teamsters Central States Fund, which has teetered close to insolvency following the Great Recession, has obligations that could drain the entire PBGC if it goes bust.

Rep. Norcross, Congress's only electrician and a former union negotiator, has made pension relief a priority over the past two years. He has championed the Butch-Lewis Act, a staple of the Democrats' economic agenda designed to win back blue-collar workers who supported President Donald Trump in 2016. Butch Lewis would establish a legacy fund within the PBGC and allow the Treasury Department to make loans to struggling systems to maintain benefit levels. Norcross said the GROW Act seeks to prevent currently healthy plans from reaching the same death spiral as Teamsters Local 707 and Ironworkers Local 17.

"The GROW Act creates a sustainable structure for multiemployer plans that workers can choose," Norcross said in a statement. "The GROW Act offers another tool in the toolbox for workers to grow their retirement savings in the future—and complements plans in Congress to honor our commitments to workers who are currently owed pension payments."

The bipartisan measure won the applause of both industry and labor groups when Roe and Norcross introduced the concept at a January press conference. Both the AFL-CIO's North American Building Trades Union (NABTU) and the Association of General Contractors, which represents mostly non-union construction companies, endorsed the plan. Michael Scott, executive director of the National Coordinating Committee for Multiemployer Plans, said keeping existing plans alive is vital, saying the retirement benefits supported "13.6 million American jobs" and contributed "$158 billion in federal taxes and more than $1 trillion" to gross domestic product in 2015. Scott said existing plans have been hampered by regulation and leave plans unattractive to employers who would otherwise join pension pools.

"The bipartisan GROW Act strengthens and modernizes the multiemployer pension system for the future at a time when the stakes could not be higher," Scott said in a statement. "The GROW Act will help safeguard this economic engine by better protecting workers' retirement security, and providing greater certainty and stability to employers in the multiemployer system."

Roe emphasized the legislation will not pose a threat to existing pension benefits. Workers who have participated in defined benefit systems will still receive them, while future workers will be enrolled in the hybrid system. Pension plans applying to switch to the hybrid model will also be required to demonstrate their fiscal health before receiving approval.

"This new plan protects the benefits workers earned under a traditional multiemployer plan, and offers stability by eliminating the uncertainty and volatility currently in the multiemployer system," Roe said.