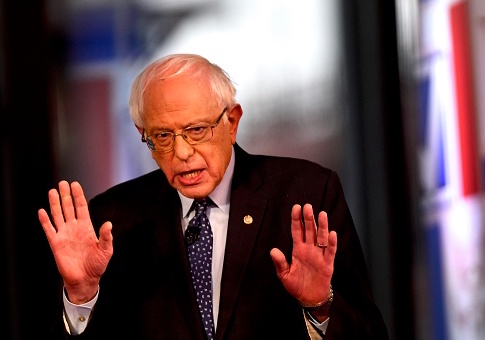

Sen. Bernie Sanders (I., Vt.) saved roughly $38,000 in taxes thanks to the Tax Cuts and Jobs Act, the Republican-passed tax cut championed by President Donald Trump which the New York Times recently admitted cut most Americans' taxes.

Sanders released ten years' worth of tax returns Monday night, fulfilling a long-standing promise to do so. The returns indicated that Sanders is now a millionaire, having collected more than $1 million in 2016 and 2017 thanks to the sales from his books Our Revolution and Bernie Sanders Guide to Political Revolution.

Sanders dodged questions about his new-found wealth during a Monday night townhall on Fox, declining to say if he would pay a top tax rate of 52 percent, the highest bracket proposed during his 2016 run for the White House. He also did not respond to a question from Fox's Martha MacCallum about if he would voluntarily give money to the government to bring his tax bill up to what he thought a fair rate was.

If he did, or if his tax plan were implemented, Sanders would increase his tax liability by nearly 30 percent, analysis of his tax returns indicates.

Sanders has not announced any substantive changes to the income tax system during his 2020 run. However, during his 2016 run, Sanders floated a comprehensive overhaul to the tax system in order to help pay for his proposed Medicare-for-All plan.

According to analysis from the right-leaning Tax Foundation, Sanders's 2016 proposal would add four new top tax brackets with rates of 37 percent, 43 percent, 48 percent, and 52 percent, It would also add a 2.2 percent "income-based [health care] premium paid by households," which the Tax Foundation writers say is "equivalent to increasing all tax bracket rates by 2.2 percentage points."

Using the Tax Foundation's estimates of Sanders's brackets, as well as the senator's reported 2018 taxable income of $519,529, we can estimate a total tax liability under his schema of $170,240.11. If Sanders were paying taxes under his own plan, he would be shelling out an additional $36,819.11 to the government, and have a tax liability of 32.7 percent of his income.

Luckily for his finances, Sanders does not live under his own tax regime. Rather, Sanders enjoyed a tax cut thanks to the TCJA, just like millions of other Americans.

"Ever since President Trump signed the Republican-sponsored tax bill in December 2017, independent analyses have consistently found that a large majority of Americans would owe less because of the law," New York Times reporters Ben Casselman and Jim Tankersley wrote on Sunday. "Preliminary data based on tax filings has shown the same."

Multiple tax-policy think tanks have provided tools to estimate tax liability with and without the TCJA. Using the information provided in Sanders's 2018 tax return, these calculators indicate major benefits to his bottom line from the TCJA. (Note: these estimators make a number of assumptions, and so may not perfectly reflect Sanders's real tax liability without the TCJA.)

One tool, provided by the Tax Policy Center (a joint project of the left-leaning Urban Institute and Brookings Institute) estimates that Sanders's income tax liability without the TCJA would have been $144,451; with the tax law, it fell to $106,782, a drop of $37,669. Another estimator from the Tax Foundation estimates a total tax liability (including payroll) of $188,753.06 before the bill and $149,773.88 afterwards, a $38,979.18 drop.

In other words, the TCJA—which Sanders voted against—saved him nearly $40,000 in taxes in 2018, roughly the additional tax burden he would have to face if his preferred tax code was implemented.