The United States' corporate tax rate of 38.91 percent is the fourth highest in the world, according to a report from the Tax Foundation.

The average corporate tax rate among the 202 countries the Tax Foundation evaluated is 22.96 percent.

There are only three places in the world—the United Arab Emirates, Comoros, and Puerto Rico—where the corporate tax rate is higher than in the United States.

"The United States statutory corporate income tax rate is 15.92 percentage points higher than the worldwide average, and 9.5 percentage points higher than the worldwide average weighted by gross domestic product," the report states. "The worldwide corporate tax rate has declined significantly since 1980 from an average of 38 percent to 22.96 percent."

According to the Tax Foundation, while the rest of the world has reduced their statutory tax rate, the United States has kept one of the highest rates in the world. The last time the United States cut the corporate tax rate was in 1986. The Tax Foundation says cutting the corporate tax rate again would encourage companies to move their investments back to this country.

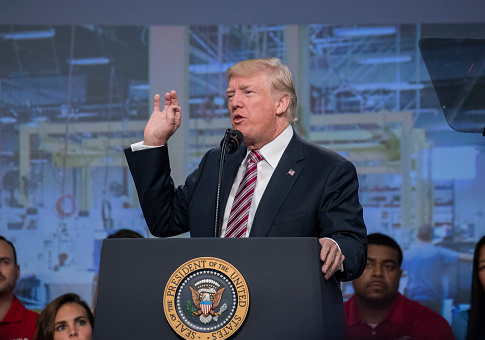

President Trump, along with two congressional committees, introduced their tax reform proposal last week, which would reduce this rate to 20 percent.

"We will cut taxes on American businesses to restore our competitive edge and create more jobs and higher wages for the American worker," said Trump last week at an event for manufacturers. "When it comes to business tax, we are now dead last among developed nations. We have the highest tax of any nation in the world—our rate is the least competitive rate."

"It is time to go from dead last to pretty much the front of the pack," Trump said. "We will dramatically cut our business tax rate so that American companies and workers can compete with our foreign competitors. This is a revolutionary change and the biggest winners will be everyday working families as jobs start pouring into our country."

Scott Hodge, president of the Tax Foundation, testified at the Joint Economic Committee hearing yesterday and explained what happens to entrepreneurs when they are making decisions about their business in relation to the tax code. Hodge brought up an example of Maria, an entrepreneur who has created a smart scooter that she wants to incorporate into personal transportation.

"If she chooses to become a C-corporation and becomes successful enough, she will eventually face one of the highest corporate taxes in the industrialized world—35 percent at the federal level and nearly 39 percent when we add in the average state rate," Hodge said. "Although it is missing some key details, the recently released tax reform framework does propose a number of policies that will improve the tax code for entrepreneurs."

"The most dramatic of these changes are the significantly lower tax rates for C-corporations and pass-through businesses," he said. "The framework proposes a 20 percent tax rate for C-corporations and a top tax rate of 25 percent for pass-through business income."

"You should aim to get the tax code out of the way of entrepreneurs by making it simpler, less burdensome, and eliminating its antigrowth biases," Hodge said to lawmakers. "Get rid of the success taxes and fix the quirks in the code that punish firms as they grow, and then tax them in a normal fashion when they succeed."