Members of Congress will hear testimony on Thursday from the administration’s point man on the Puerto Rico debt crisis, a former investment banker who last year was paid millions by a company with business interests in the U.S. territory.

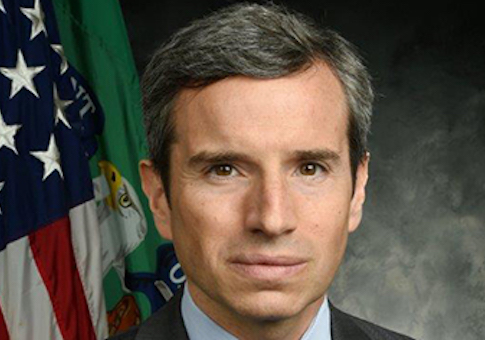

Antonio Weiss, a Treasury Department counselor leading the agency’s response to Puerto Rican financial woes, will brief members of the House Natural Resources Committee on "the situation in Puerto Rico."

The hearing comes as the U.S. commonwealth’s government eyes increasingly drastic measures to stave off a financial reckoning. Puerto Rican officials are seeking relief from the federal government in the face of $72 billion in public debt that it says is unpayable.

Weiss’ role in the administration’s response to the crisis has come under scrutiny since he was nominated for the third ranking position at Treasury in 2014. Sen. Elizabeth Warren (D., Mass.) led a successful effort to sink his nomination, citing his ties to major financial institutions.

The president withdrew his nomination in January 2015. Instead, Weiss joined Treasury as counselor. But allegations of a conflict of interest persisted and could cast a shadow over his testimony on Thursday.

At issue are his ties to Lazard, a financial advisory and asset management firm based in New York and incorporated in Bermuda. Before joining Treasury, Weiss was a partner at the firm and the head of its investment-banking arm.

He is also a high-dollar Democratic donor, having contributed nearly $150,000 to a host of candidates and party organs since 2007, including the maximum legal contributions to both of President Obama’s campaigns.

Weiss resigned his position at Lazard when he joined Treasury. But he also reached a deal with the company that allowed him to redeem unvested stock and compensation options ahead of schedule, netting him as much as $21 million upon his departure.

As he awaited consideration of his 2014 Treasury nomination, Weiss told Treasury officials that he would "not participate personally and substantially in any particular matter involving specific parties in which I know Lazard is a party or represents a party, unless I first receive a written waiver."

He has not received a waiver subsequent to that statement, but there is disagreement on whether his role in the administration’s response to the Puerto Rican debt crisis runs afoul of that pledge.

Weiss’ critics say it’s obvious that his work for Treasury has the potential to affect Lazard’s bottom line.

Hedge Clippers, an activist group critical of large financial firms, has pointed to Lazard’s stated interest in selling Puerto Rican government securities to its hedge fund clients.

"As more hedge funds buy and sell [Puerto Rican] securities, the firm wants to capture that trading revenue," a former Lazard executive said in 2013, according to a Bloomberg report at the time.

"For this reason alone Weiss should recuse himself" from "all Treasury activity relating to Puerto Rico and the Island’s debt crisis," Hedge Clippers said in a September report.

According to the report, Lazard manages a hedge fund with stakes in Puerto Rican government bonds. It reportedly has a number of other financial interests on the island.

"Lazard’s U.S. Tax-Exempt Bond Fund reported exposure to the country as recently as 2014. Lazard’s Opportunities fund has investments in a Puerto Rico bank. The firm’s private equity arm, Edgewater Growth Capital Partners, has an investment in Vertical Bridge Holdings LLC, a cell tower leasing company whose CEO sees Puerto Rico as ‘an attractive region.’ Lazard is also a registered broker-dealer in Puerto Rico," according to the Hedge Clippers report.

"There are twenty-one million reasons for Treasury official Antonio Weiss to stay far away from policy related to Puerto Rico, debt and Lazard while he’s working for the American people," the report concluded.

Treasury does not deny that Weiss’ former employer has financial interests in the Puerto Rican bond market and its larger economy. But it says his role at Treasury does not violate revolving door restrictions designed to avoid conflicts of interest.

"The fiscal and economic crisis in Puerto Rico raises broad-based policy issues and Counselor Weiss has been fully and appropriately engaged in efforts to formulate the Administration’s policies to help stem the crisis and put Puerto Rico back on a path to growth," a Treasury spokesman said in an emailed statement.

Key to Treasury’s defense of Weiss’ role are the specific definitions of statutory language designed to prevent conflicts of interest among executive branch officials.

While former federal employees are restricted in making policy that directly affects their former employers, federal law provides broad exceptions for what it calls "matters of general applicability."

Treasury’s position is that because Weiss’ work is not focused on Lazard’s specific business interests—he is not making decisions at that micro level—he is well within the bounds of acceptable conduct.

However, Hedge Clippers and a coalition of liberal groups say that even the perception of a conflict should spur Weiss to recuse himself.

"Given Lazard’s ties to the Puerto Rican debt crisis, your recusal is necessary to preserve the appearance of neutrality in Treasury’s actions," the groups said in a September letter to Weiss.