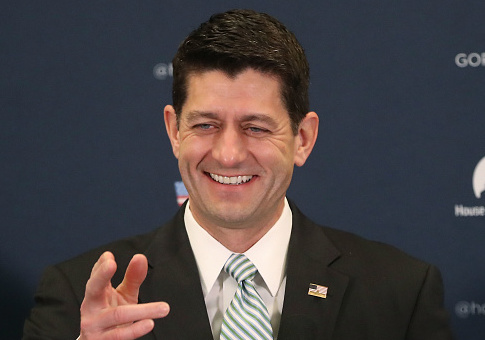

The House Republican tax reform plan introduced by Speaker Paul Ryan (R., Wis.) would create 1.7 million jobs and increase after-tax incomes on average by 8.7 percent, according to a report from the Tax Foundation.

The plan lowers marginal tax rates on wage, investment, and business income as well as simplifying the tax code so that it could fit on a postcard. The reform package would also lower the corporate tax rate to 20 percent, broaden the tax base, and eliminate federal estate and gift taxes.

The group analyzed the GOP blueprint, also known as "A Better Way," to evaluate the state-by-state impact on jobs and income.

On a national level, the analysis found that the plan would create 1,687,000 new full-time jobs and increase the after-tax incomes of median households by $4,917. The increase in jobs and income growth are due to the plan's ability to increase productivity and economic growth as well as income tax cuts.

"Our analysis found that the plan would significantly reduce the cost of capital and reduce the marginal tax rate on labor," the report states. "These changes in the incentives to work and invest would greatly increase the U.S. economy's size in the long run, boost wages, and result in more full-time equivalent jobs."

The analysis finds that as a result of the plan, 9,154 new jobs would be created in Washington, D.C., and incomes for households in the area would rise by $6,096. California would see the most job gains, with the plan adding 191,767 full-time jobs, followed by Texas with 140,374 jobs, and New York with 109,733 jobs. The state-by-state run down of jobs and income growth can be seen here.

"There are a lot of reasons to support the GOP plan," said Speaker Ryan. "It will level the playing field for American businesses, simplify the tax code to make it flatter and more fair, and usher in a new era of economic growth in our country."

"Ultimately, this is about making sure you can find good-paying jobs and keep more of your hard-earned paychecks," he said. "The moment to fix our broken tax code is now."