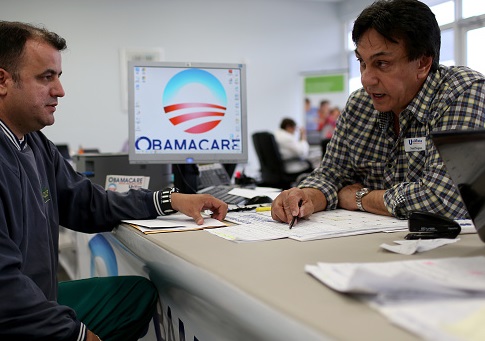

Four million Americans paid $2.8 billion in Obamacare penalties for not having health insurance on target year 2016 returns through April 27, 2017, according to data from the Taxpayer Advocate Service, a division of the Internal Revenue Service.

Beginning in 2014, the Affordable Care Act's individual mandate required Americans to purchase health care coverage or pay a penalty to the IRS.

At that time, individuals without insurance had to pay either a flat fee of $95 or 1 percent of the household's adjusted gross income in excess of the threshold for mandatory tax filing, whichever was greater. In 2016, those numbers increased to a flat fee of $695 or 2.5 percent of the gross income.

The report finds that this number increased again, as the 4 million individuals paid an average penalty of $708.

On President Donald Trump's first day in office, he signed an executive order to minimize the economic burden of the Affordable Care Act, which meant the IRS could waive the individual mandate penalty.

"The order stated that the agencies should exercise all authority and discretion to waive, defer, grant exemptions from, or delay the implementation of any requirement of the Act that would impose burden," the taxpayer advocate explains.

This means individuals were allowed to either forego checking a box that indicated they had health care coverage, complete a form to show they were exempt from the penalty, or self-assess a penalty on their return. These types of tax returns are described as "silent" returns by the IRS.

Less than a month after Trump's executive order was signed, the IRS decided to begin rejecting these "silent returns."

According to the taxpayer advocate's data, the number of people who decided to pay a penalty declined 28.6 percent over the year. In target year 2015 through April 28, 2016, there were 5.6 million Americans who paid the penalty. In target year 2016 through April 27, 2017, 4 million Americans paid the penalty.

In addition, the number of silent returns increased by 200,000 in a year. In target year 2015, there were 7.8 million silent returns and in target year 2016 that increased to 8 million.

"The IRS is in the process of assessing various options to address silent returns filed in past as well as future filings, including the reinstatement of the plans to reject electronically filed silent returns, the issuance of educational or soft notices, and the issuance of penalty assessment notices," the taxpayer advocate says.

"The National Taxpayer Advocate supports any efforts to reinstate plans to reject electronically filed silent returns as well as issue educational and soft notices," the report states. "These options would help the taxpayer avoid future compliance problems."