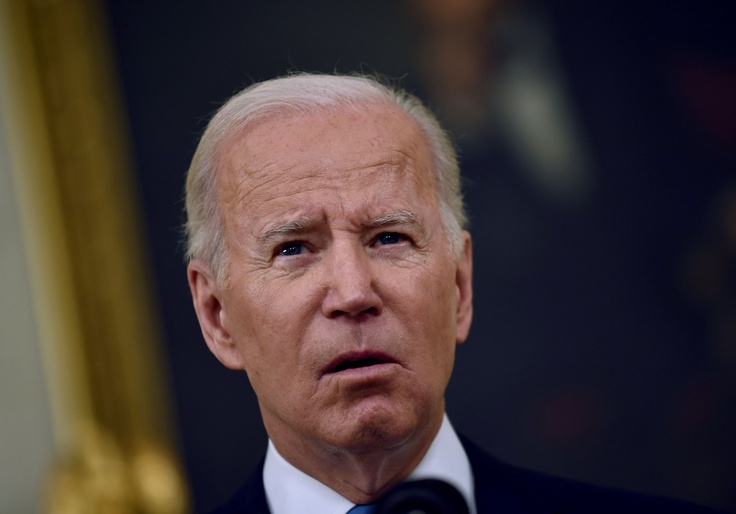

President Joe Biden's decision to mandate that all private health insurers cover up to eight at-home COVID-19 tests for individuals each month could cost hundreds of billions of dollars annually—charges that could cause an increase in premiums for policy holders.

If the roughly 215 million Americans with private health insurance take full advantage of the offer, insurance companies could be on the hook for more than $20 billion a month, according to a Free Beacon analysis. The administration has ordered insurance companies to reimburse individuals up to $12 for each purchased test, allowing for up to $96 in reimbursements a month for every insured individual. That's more than $1,000 annually.

It is of course highly unlikely that every insurance holder will order the maximum number of covered tests—the new policy allows for a family of four to get eight tests each, a whopping 32 in total for the household. Most Americans do not take a single test each month. According to the CDC, the seven-day average number of tests reported for Dec. 24 to 30, 2021, was 1,652,836, a small fraction of the total number of tests insurance companies are being asked to provide. But the Biden administration is working to change that, leaning in on testing as the best tool to slow the spread of the new Omicron variant. The administration has pledged to distribute them en masse throughout the country, and the new mandate on insurance companies is part of that effort.

In the announcement of the policy, the Department of Health and Human Services declined to say what kind of financial arrangement was reached between the federal government and private health insurance companies. Secretary Xavier Becerra said that the mandate "is all part of our overall strategy to ramp-up access to easy-to-use, at-home tests at no cost." The cost of the tests will likely be reflected in increased premiums for policy holders. Prior to Biden's mandate, insurance companies were only required to cover tests ordered by medical professionals, usually for patients exhibiting symptoms of COVID-19.

A study by the actuarial services firm Milliman projected that "essential health benefits" requirements in Obamacare, which mandated health insurance plans to cover a range of new services, were responsible for up to a 17 percent increase in premiums.

Insurance companies have expressed concerns about the new policy, which was released on Monday and takes effect on Saturday. Kim Keck, CEO of insurance giant Blue Cross Blue Shield, said it will be hard to meet the new standard with such short notice.

"We are concerned that the policy does not solve for the limited supply of tests in the country and could cause additional consumer friction as insurers stand up a program in just four days' time," Keck said.

Michael Bagel, director of public policy at the Alliance of Community Health Plans, told Politico that insurance companies will struggle to negotiate costs of tests due to the government order, which gives them little to no flexibility.

"This is an unfunded mandate on insurers and consumers," Bagel told the outlet. "There's nothing but barriers to get it set up in time. We have essentially 96 hours to ... get the operational pieces in place."

Insurance companies are being asked to make tests available directly to policy holders, and there is no guarantee they will be able to find tests for as little as $12. At-home testing kits are sold in stores for prices ranging from $14 to $34, according to the New York Times, and they're becoming increasingly hard to find with increased demand caused by the quick spread of the Omicron variant.

The White House also announced a plan to purchase over 500 million tests for Americans who ask for one, putting an additional strain on insurance companies looking to procure their own stockpiles. Details on that plan, including how individuals can obtain one, have yet to be released.