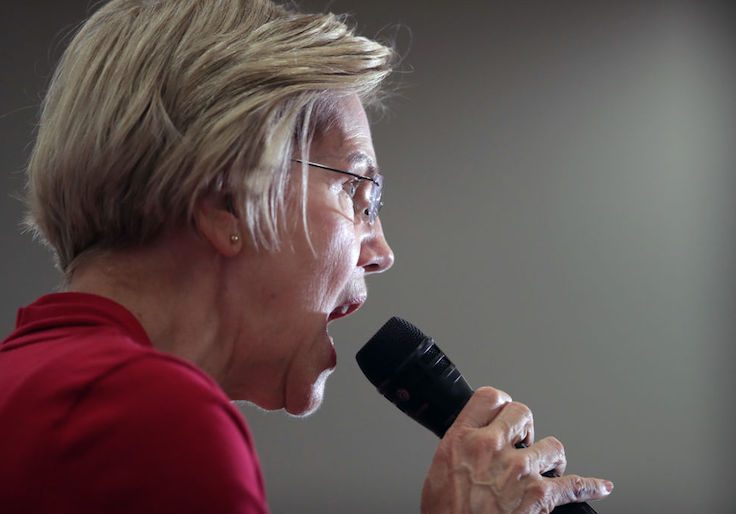

A new projection from the Penn Wharton Budget Model finds that the wealth tax supported by Democratic presidential candidate Sen. Elizabeth Warren (D., Mass.) would hinder the nation's economic growth.

The nonpartisan, research-based initiative calculated in an analysis due to be released Thursday afternoon that under the Massachusetts senator's plan, "annual economic growth would slow from an average of 1.5 percent to an average of just over 1.3 percent over a decade," equivalent to a roughly 13 percent reduction.

The analysis comes as economists and conservative analysts have criticized Warren's economic plans as based on unrealistic assumptions. Warren's Medicare for All proposal, for example, estimates a price tag of only $20.5 trillion across 10 years, despite the liberal Urban Institute placing the cost at around $34 trillion.

Penn Wharton director of policy analysis Richard Prisinzano told the New York Times that the reduction in growth would stem from wealthy Americans consuming more and investing less.

"The wealth tax shrinks the economy because saving is more expensive," he said. "The results also suggest that the negative effect of the tax increases as the tax rate increases."

Penn Wharton's model takes at face value the Warren campaign's claim—disputed by some economists—that the wealth tax would rise $3 trillion in revenue. It also assumes that the $3 trillion would be used to pay off the national debt, which in the model would encourage growth by stimulating investment. In Warren's actual plan, the money would be spent on projects such as free childcare and student loan forgiveness, with uncertain effects on GDP growth.