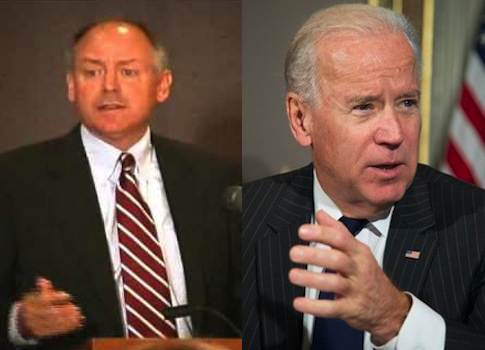

Vice President Joe Biden secured estate tax hikes as part of the final fiscal cliff package while employing a former top lobbyist for the life insurance industry, which is set to benefit from the legislation.

The deal raised death taxes from 35 to 40 percent on wealth in excess of $5.12 million. The entire fiscal cliff deal is expected to generate $620 billion for the federal government over the next ten years.

Life insurance companies, which offer products that allow wealthy Americans to dodge the tax hike, will also benefit. Life insurance interest groups, including the Association for Advanced Life Underwriting (AALU) and American Council of Life Insurers (ACLI), welcomed the deal’s Tuesday night passage.

"The showing of significant bipartisan support for permanent [estate tax] reform with unification is an important development and reflects the substantial effort in support of those reforms made by the AALU and our volunteers over the past several years," AALU said in a statement.

One of the AALU’s chief allies was Steve Ricchetti, a former lobbyist and top adviser to Biden.

Ricchetti Inc., the lobbying shop started by Ricchetti and his brother Jeff in 2001, has pocketed more than $3 million in lobbying fees from the ACLI and AALU over the past decade. The AALU remains the firm’s second largest client.

Ricchetti served as the public face of a campaign to reinstitute the estate tax after the Bush administration eliminated it as part of its 2001 reforms. He headed the Coalition for America’s Priorities, a 501(c)4 advocacy group that paid $750,000 to air an ad mocking heiress Paris Hilton. FactCheck.org blasted the ad for falsely implying that the estate tax funded Social Security.

The same life insurance interests that paid Ricchetti’s company millions in fees funded the ad buy, according to the Club for Growth.

"There is a big moral dimension [of the tax]," Ricchetti told the Christian Science Monitor in 2006. "[America] was not founded on the principle of inherited wealth."

The Obama administration used similar language to justify the tax hikes in the fiscal cliff deal.

"The agreement raises the tax rate on the wealthiest estates—worth upwards of $5 million per person—from 35 percent to 40 percent, in contrast to Republican proposals to continue the current estate tax levels," leaked White House talking points said.

The vice president caused a stir in March when he tapped Ricchetti as a top adviser. While Ricchetti had previously served as an adviser to former President Bill Clinton, his high-profile lobbying career led some to question whether his appointment violated Obama’s pledge to keep his White House K-Street free.

The White House justified the hiring by saying that Ricchetti had not registered as a lobbyist since 2008, though he had "advised clients on public policy, communications strategy, and grassroots efforts."

Such assurances did not ease the concerns of transparency and consumer advocates, including the nonprofit group Knowledge Ecology International.

"We write today to request that you recuse yourself from any matters that may involve the interest of any of your former clients, or current clients to Ricchetti, Inc.," KEI wrote in a letter to the White House in March. "We are particularly concerned about conflicts of interest pertaining to intellectual property rights for biomedical inventions, the pricing and regulation of biomedical inventions, and the regulation of hospitals and insurance companies."

The White House did not respond to requests for comment.